Navigating the complex world of personal finance is a constant juggling act for professionals. With demanding careers and mounting living costs, it's crucial to hone strong financial habits. A solid understanding of budgeting, investing, and debt management gives you the leverage you need to achieve your fiscal goals.

Allow me to explore some key strategies for controlling your finances as a professional.

* **Create a Comprehensive Budget:** A well-structured budget forms the foundation of your financial plan. Track your income and expenses thoroughly to pinpoint areas where you can reduce spending.

* **Prioritize Saving:** Develop a consistent savings habit by setting aside a percentage of your income each month.

Think about different savings options, such as high-yield savings accounts.

* **Invest Wisely:** Investing plays a crucial role in building long-term wealth. Research various investment vehicles, such as stocks, bonds, and financial planning for professionals mutual funds.

Consider seeking guidance from a investment professional to craft an investment portfolio that aligns with your risk tolerance and objectives.

* **Manage Debt Effectively:** Control your debt by making timely payments and considering strategies for reducing interest rates. Avoid taking on unnecessary debt.

Wealth Management Strategies for Top Earners

For high earners, effective investment strategy is paramount to securing their future. Beyond simply earning a substantial salary, these individuals require tailored strategies to optimize their wealth. A comprehensive plan should encompass diverse areas such as estate planning, along with strategies for investment growth. Consultants specializing in high-net-worth individuals can provide invaluable advice in navigating the complexities of wealth management and ensuring long-term financial success.

- Creating a detailed spending plan

- Utilizing retirement savings plans

- Allocating assets across various sectors

Building for Success: Creating a Future

Building a secure future requires careful planning and a commitment to financial well-being. Saving wisely is one of the most effective ways to achieve this goal. It allows your money to Grow over time, providing you with greater financial Security in the years to come. A well-crafted Retirement plan should consider your individual needs and Objectives. It's crucial to Spread your investments across different asset classes to Minimize risk and maximize potential returns. Utilizing the expertise of a qualified financial advisor can provide invaluable guidance as you navigate the world of investing. Remember, Investing is a long-term journey that requires patience, discipline, and informed decision-making.

Enhance Your Wealth: A Financial Blueprint for Professionals

In the fast-paced world of professional life, it's essential to build a solid investment foundation. Crafting a well-structured financial blueprint can facilitate you to achieve your long-term aspirations. This involves meticulously planning for financial security, controlling your portfolio, and reducing financial threats.

- Strategic investment is key to generating wealth over time.

- Risk management across various industries can help reduce potential losses.

- Regular contributions to retirement plans are essential for a comfortable retirement.

By implementing these guidelines, you can enhance your wealth and build a prosperous future.

Transcending the Salary: Comprehensive Financial Planning for Professionals

Securing a competitive salary is undoubtedly a major goal for aspiring professionals. However, true financial prosperity extends far beyond just income. A robust financial plan is essential to navigate the complexities of modern life and attain long-term stability.

It involves a thoughtful approach to managing your finances, encompassing multiple facets: expense management, asset growth, debt mitigation, safety net planning, and inheritance strategies.

By embracing a well-rounded financial plan, professionals can optimize their earning potential, protect their future, and enable themselves to pursue their dreams with confidence.

Financial Literacy for Career Advancement

Investing in your financial literacy isn't just about saving money; it's a crucial action towards career advancement. A strong grasp of financial concepts equips you to make informed choices that can propel your professional growth. Comprehending budgeting, investing, and debt management empowers you to take ownership of your financial future, freeing up valuable time and resources to concentrate on career development opportunities.

- Build a solid foundation in personal wealth management through online courses, workshops, or mentorship programs.

- Track your income and expenses diligently to create a realistic budget that supports your objectives.

- Consider diverse investment options aligned with your risk tolerance and distant financial visions.

By prioritizing your financial literacy, you're not only securing a brighter future for yourself but also positioning yourself as a competent asset in the professional world.

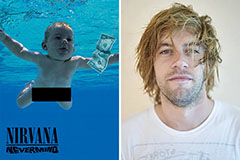

Spencer Elden Then & Now!

Spencer Elden Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Michael Fishman Then & Now!

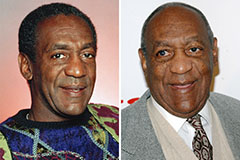

Michael Fishman Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!